Re-KYC or Repression? Banks Are Freezing Citizens, Not Fraud

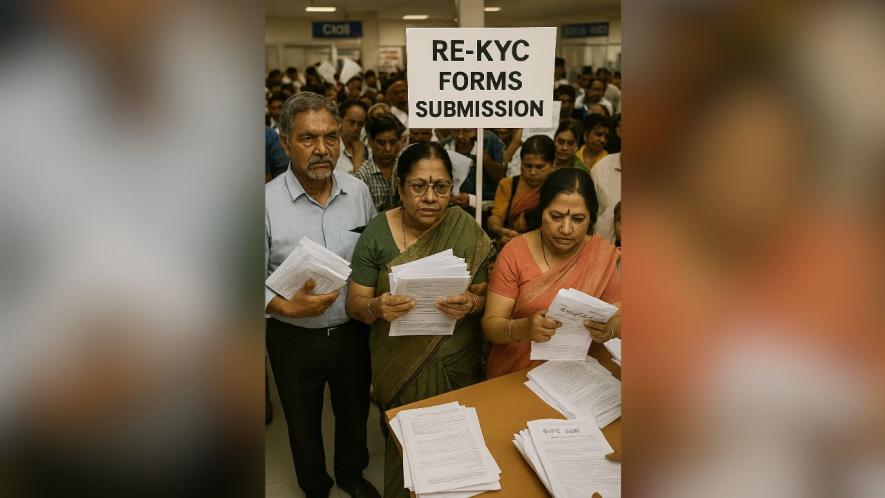

At a major public sector bank in Delhi, the account of its own Ex-Officers’ Association was abruptly frozen. The reason? Alleged non-submission of a form to claim staff-related interest benefits. But when the association approached the branch—staffed by successors of their own cadre—it turned out the freeze had nothing to do with interest forms. It was a blanket re-KYC enforcement, triggered without notice, without communication, and without cause.

The irony was bitter. Retired officers, who once upheld banking standards, were now victims of a system so hollow it couldn’t distinguish between fraud and familiarity. The current officials, lacking both institutional memory and procedural clarity, had turned compliance into chaos—freezing the very hands that once ran the bank.

In another incidence, Meena Sharma, a 72-year-old retired schoolteacher in Jaipur, hadn’t changed her address, phone number, or documents in over a decade. Her pension arrived like clockwork—until one morning, her account was frozen. No fraud. No alert. Just a missed re-KYC deadline she was never informed about. She visited her bank branch twice, queued for hours, and was told to resubmit documents she had already submitted three years earlier—at the time of account opening. Her Aadhaar was valid. Her PAN was unchanged. Her only “risk factor”? Being stable.

India’s banking system is caught in a paradox. Designed to safeguard against financial crime, Know Your Customer (KYC) norms have devolved into a bureaucratic ritual that punishes the very citizens it was meant to protect.

Millions of low-risk customers—pensioners, students, salaried employees, welfare recipients—face account freezes not for fraud, but for missing arbitrary re-KYC deadlines. This isn’t vigilance. It’s banking-level absurdity.

Despite RBI’s clear guidelines, banks continue to enforce blanket re-KYC procedures—even on accounts with no changes in address, phone number, or personal details. The result? A compliance regime that criminalises stability, punishes the punctual, and erodes public trust.

What RBI Actually Mandates: A Risk-Based, Citizen-Friendly Framework

RBI’s Master Direction on KYC lays out a globally aligned, risk-sensitive model:

Re-KYC is triggered only when:

-

The timeline expires based on risk category

-

There’s a change in address, occupation, or contact details

-

Previously submitted documents expire or become invalid

-

Documents no longer match RBI’s list of Officially Valid Documents (OVDs)

Deemed OVDs (Address Only – Valid for 3 Months):

-

Recent utility bills

-

Property tax receipts

-

Pension payment orders

-

Employer-issued accommodation letters

These are temporary and must be replaced with a valid OVD within three months.

Simplified Re-KYC for Stable Accounts

For accounts with no change in information, RBI permits:

-

Self-declaration via email, SMS, ATM, or mobile banking

-

No need for branch visits or document resubmission

If only one detail (e.g., occupation or phone number) has changed:

-

Customers should update that specific field

-

Banks may request supporting documents

-

Full re-KYC is not mandated unless existing documents are expired or invalid

If only the address has changed:

-

It can be updated digitally

-

Banks must verify it within two months

-

What RBI Allows vs. What Banks Enforce

The RBI permits modular updates—banks enforce blanket resets. A phone number change should not trigger a full compliance cycle. An address update should not require a branch visit. Yet banks continue to treat every minor change as a gateway to procedural excess.

This isn’t just inefficiency—it’s a betrayal of regulatory intent. When banks ignore RBI’s simplified re-KYC model, they don’t just inconvenience citizens—they criminalise stability.

The RBI’s modular KYC model is built on trust and proportionality. Banks, however, continue to operate as if every update is a threat. This isn’t compliance—it’s institutional paranoia masquerading as diligence.

Citizens deserve a system that respects continuity. When banks criminalise minor changes, they don’t just defy RBI—they undermine procedural justice.

Institutional Inertia: How Banks Betray RBI’s Intent

Despite RBI’s clarity, banks persist with outdated, one-size-fits-all enforcement. This betrayal manifests in six key failures:

1. Violation of Simplified Re-KYC

-

RBI allows remote self-declaration

-

Banks still demand in-person visits

-

Result: Frozen accounts, public frustration

2. Technological Stagnation

-

RBI promotes Video-based Customer Identification (V-CIP)

-

Many banks haven’t implemented it

-

Result: Long queues, exclusion of digitally capable users

3. Disruption of Core Banking Services

-

Blanket re-KYC drives divert staff from essential services

-

Result: Delayed loans, poor grievance redressal

4. Erosion of Public Trust

-

Routine compliance becomes punitive

-

Result: Resentment, reputational damage

5. Disregard for RBI’s Risk-Based Model

-

Banks treat all customers as high-risk

-

Result: Panic, criminalization of low-risk citizens

6. Non-compliance with Acknowledgement Norms

-

RBI requires banks to acknowledge KYC submissions

-

Many banks fail to do so

-

Result: Confusion, repeated submissions

The Hidden Costs: Fiscal Drain and Human Harm

The financial cost of this ritualistic enforcement is staggering.

Industry estimates suggest that each re-KYC cycle costs banks between ₹100–₹300—covering staff time, printing, verification, and customer outreach.

Multiplied across 30 to 50 million accounts, this amounts to a fiscal drain exceeding ₹5,000–₹10,000 crores per year, with no proportional gain in fraud prevention or risk mitigation.

These resources—meant for innovation, digital inclusion, and better customer service—are instead consumed by redundant compliance.

The human cost is equally severe: anxiety, disrupted livelihoods, and eroded trust in institutions.

Welfare payments are blocked, salaries delayed, pensioners stranded. Frontline staff are overwhelmed by avoidable paperwork.

This isn’t just procedural excess—it’s institutional harm. A system designed to protect citizens is now punishing them for their stability.

Human Cost

The human cost is equally severe: anxiety, disrupted livelihoods, and eroded trust in institutions.

What should be a routine safeguard has become a source of exclusion and distress.

Consequences include:

-

Anxiety, disrupted livelihoods, and eroded trust

-

Welfare payments blocked, salaries delayed, pensioners stranded

-

Frontline staff overwhelmed by avoidable paperwork

This isn’t just procedural excess— it’s a failure of banking logic.

Stop Punishing Citizens—Start Reforming Institutions

India’s re-KYC regime isn’t broken by design—it’s broken by execution.

RBI’s framework is clear, calibrated, and citizen-friendly. The real failure lies in how banks enforce it: with rigidity, indifference, and outdated methods that punish the very people they’re meant to serve.

But reform cannot be left to banks alone. RBI, the Ministry of Finance, and bank managements must:

-

Enforce risk-based proportionality

-

Penalize procedural overreach

-

Invest in digital infrastructure that respects both regulation and dignity

What Citizens Can Do

Systemic improvement demands citizen action. If you’re facing unjust re-KYC enforcement:

-

File complaints with your bank’s grievance cell

-

Escalate to the Banking Ombudsman or RBI’s Complaint Portal

-

Tag RBI, MoF, and bank handles on social media with documented cases

-

Engage consumer forums and media to spotlight failures

-

Demand written acknowledgement of submissions, as mandated by RBI

Blanket procedures that ignore customer profiles, digital options, and RBI’s own directives do more than inconvenience—they erode public confidence, waste institutional resources, and betray the spirit of financial inclusion.

This isn’t just bad policy—it’s bad governance.

Citizens deserve dignity, not default punishment.

The writer has 37 years’ experience in private and nationalised banks, an MBA in finance, specialising in currency derivatives, a CAIIB (Certified Associate of the Indian Institute of Bankers), and former Deputy General Secretary of All India Bank Officers’ Confederation or AIBOC. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.